Money Printer Goes Quiet and Argentine Government Gets Squeezed

Ignacio Olivera Doll, 28 April 2021

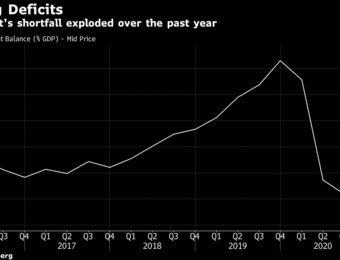

The Argentine central bank’s fight against inflation is upending the local bond market and squeezing government finances as the country struggles to regain traction while the pandemic rages on.

The Argentine central bank’s fight against inflation is upending the local bond market and squeezing government finances as the country struggles to regain traction while the pandemic rages on.

Long known as some of the world’s most prolific money printers, Argentine policy makers are cutting back on the largesse in an effort to curb inflation running at more than 40% a year. While the move toward orthodoxy has often been urged by economists, the timing is difficult. Slower expansion of the money supply over the past six months has cut liquidity and sapped demand for debt, pushing up interest rates and making it harder for the government to fund itself given its lack of access to overseas markets. Continue reading “Article: Money Printer Goes Quiet and Argentine Government Gets Squeezed”

In March 2014, a few days after Vladimir Putin’s forces invaded Crimea, a British official arriving for a meeting of the UK’s National Security Council failed to shield his notes from the Downing Street photographers. Any response to the Kremlin’s aggression should not, the notes read, “close London’s financial centre to Russians”. The government subsequently explained that it “wanted to target action against Moscow and not damage British interests”.

In March 2014, a few days after Vladimir Putin’s forces invaded Crimea, a British official arriving for a meeting of the UK’s National Security Council failed to shield his notes from the Downing Street photographers. Any response to the Kremlin’s aggression should not, the notes read, “close London’s financial centre to Russians”. The government subsequently explained that it “wanted to target action against Moscow and not damage British interests”. It was only when John made a final phone call to confirm the transfer of about €10m to his family trust that he realised he was about to fall victim to a highly sophisticated financial scam.

It was only when John made a final phone call to confirm the transfer of about €10m to his family trust that he realised he was about to fall victim to a highly sophisticated financial scam. Fraudsters, drug dealers and money mules have revealed how crime has gone cashless during the pandemic.

Fraudsters, drug dealers and money mules have revealed how crime has gone cashless during the pandemic. In a high-security, 1,000-capacity courtroom converted from a call centre, Italy’s largest mafia trial in three decades is under way in Lamezia Terme, Calabria. About 900 witnesses are set to testify against more than 350 defendants, including politicians and officials charged with being members of the ’Ndrangheta, Italy’s most powerful criminal group.

In a high-security, 1,000-capacity courtroom converted from a call centre, Italy’s largest mafia trial in three decades is under way in Lamezia Terme, Calabria. About 900 witnesses are set to testify against more than 350 defendants, including politicians and officials charged with being members of the ’Ndrangheta, Italy’s most powerful criminal group. SINGAPORE – About $69 million transferred through suspicious accounts here has been intercepted by the authorities since 2019.

SINGAPORE – About $69 million transferred through suspicious accounts here has been intercepted by the authorities since 2019. The battering to Wall Street banks from Archegos Capital Management topped $10 billion after UBS Group AG and Nomura Holdings, Inc. reported fresh hits caused by the fund’s collapse.

The battering to Wall Street banks from Archegos Capital Management topped $10 billion after UBS Group AG and Nomura Holdings, Inc. reported fresh hits caused by the fund’s collapse. July 31 can’t come soon enough for several GameStop executives, including CEO George Sherman, who are slated to exit the videogame retailer at that time in a management reorganization driven by incoming chairman of the board Ryan Cohen, co-founder/CEO of online pet supply service Chewy.com.

July 31 can’t come soon enough for several GameStop executives, including CEO George Sherman, who are slated to exit the videogame retailer at that time in a management reorganization driven by incoming chairman of the board Ryan Cohen, co-founder/CEO of online pet supply service Chewy.com.