How the pandemic became an EU goldmine for crime

ANDREW RETTMAN, 13 April 2021

The recession set to hit Europe after the pandemic will help organised crime penetrate legitimate business and recruit out-of-work specialists, the EU’s joint police agency, Europol, has warned.

The recession set to hit Europe after the pandemic will help organised crime penetrate legitimate business and recruit out-of-work specialists, the EU’s joint police agency, Europol, has warned.

“Businesses operating in sectors suffering particularly negative economic pressures, such as the hospitality, catering and tourism sectors, are becoming more vulnerable to criminal infiltration,” it said in a report out on Monday (12 April). Continue reading “Article: How the pandemic became an EU goldmine for crime”

It is not often noted that the U.S. Treasury too injects the economy with cash flow, on top of various stimulus packages. With a precarious economic balance such as it is, excess liquidity may yet be another trigger to make inflation worse.

It is not often noted that the U.S. Treasury too injects the economy with cash flow, on top of various stimulus packages. With a precarious economic balance such as it is, excess liquidity may yet be another trigger to make inflation worse. The global system for financial crime is hugely expensive and largely ineffective.

The global system for financial crime is hugely expensive and largely ineffective. Shares in Alibaba surged on Monday after the e-commerce company said that a record $2.8bn (£2bn) fine handed down by Chinese regulators marked the end of an investigation into anti-competitive practices at the company.

Shares in Alibaba surged on Monday after the e-commerce company said that a record $2.8bn (£2bn) fine handed down by Chinese regulators marked the end of an investigation into anti-competitive practices at the company. No 10 is to a launch an independent investigation into former prime minister David Cameron’s lobbying for the now-collapsed Greensill and the role of the scandal-hit financier Lex Greensill in government.

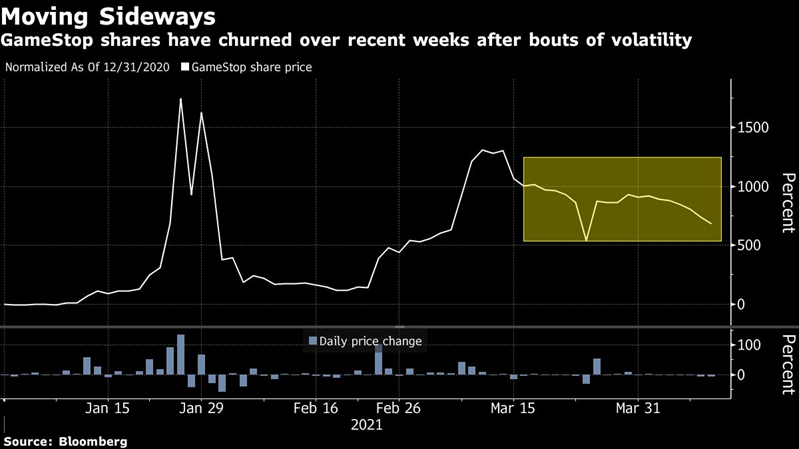

No 10 is to a launch an independent investigation into former prime minister David Cameron’s lobbying for the now-collapsed Greensill and the role of the scandal-hit financier Lex Greensill in government. (Bloomberg) — GameStop Corp.’s Reddit-fueled trading surge is likely going to fade as threats from digital game downloads sink in, according to one skeptical Wall Street analyst.

(Bloomberg) — GameStop Corp.’s Reddit-fueled trading surge is likely going to fade as threats from digital game downloads sink in, according to one skeptical Wall Street analyst. As cases of fraud and money laundering rose during the pandemic last year, banks in the UK faced unforeseen challenges. In a new study by global analytics software provider FICO and independent research firm OMDIA, 79 per cent of respondents from UK banks said that working from home had a high or major impact on the effectiveness of their financial crime prevention.

As cases of fraud and money laundering rose during the pandemic last year, banks in the UK faced unforeseen challenges. In a new study by global analytics software provider FICO and independent research firm OMDIA, 79 per cent of respondents from UK banks said that working from home had a high or major impact on the effectiveness of their financial crime prevention. Cybercrime complaints soared to a record high last year, when total losses surpassed $4.2 billion and losses to those 50 and older exceeded $1.8 billion, according to FBI data for 2020.

Cybercrime complaints soared to a record high last year, when total losses surpassed $4.2 billion and losses to those 50 and older exceeded $1.8 billion, according to FBI data for 2020. A former Royal Bank of Scotland trader is suing the lender for more than £1.1 million ($1.5 million), claiming he is being denied promised bonuses after being unlawfully dismissed during a regulatory investigation into the Libor rate-rigging scandal.

A former Royal Bank of Scotland trader is suing the lender for more than £1.1 million ($1.5 million), claiming he is being denied promised bonuses after being unlawfully dismissed during a regulatory investigation into the Libor rate-rigging scandal. Former Portage Clerk-Treasurer Christopher Stidham will have to give up his law license and the chance of future work in the public sector, much less a run for office, after being sentenced Monday on a Level 6 felony count of conflict of interest.

Former Portage Clerk-Treasurer Christopher Stidham will have to give up his law license and the chance of future work in the public sector, much less a run for office, after being sentenced Monday on a Level 6 felony count of conflict of interest. Treasury Secretary Janet Yellen will decline to name China as a currency manipulator in her first semiannual foreign-exchange report, according to people familiar with the matter, a move that allows the U.S. to sidestep a fresh clash with Beijing.

Treasury Secretary Janet Yellen will decline to name China as a currency manipulator in her first semiannual foreign-exchange report, according to people familiar with the matter, a move that allows the U.S. to sidestep a fresh clash with Beijing.