BlackRock, State Street Exploring Takeover Of Credit Suisse Asset Management Arm

TYLER DURDEN, 09 April 2021

Earlier, several financial media outlets reported that Credit Suisse was considering dramatically shrinking or selling off its prime brokerage unit, the hedge-fund-focused business that just lost $4.7 billion for the bank, obliterating 18 months of the bank’s average net profits.

Earlier, several financial media outlets reported that Credit Suisse was considering dramatically shrinking or selling off its prime brokerage unit, the hedge-fund-focused business that just lost $4.7 billion for the bank, obliterating 18 months of the bank’s average net profits.

But in the last few hours, the focus has shifted to the bank’s asset management unit, amid reports that several American firms might be interested in making a bid, even as the bank has yet to release the final tally of expected losses from the Greensill debacle. Continue reading “Article: BlackRock, State Street Exploring Takeover Of Credit Suisse Asset Management Arm”

Back in December, Bloomberg published a sweeping expose that raised serious questions about the ESG investing craze sweeping the world. In the piece, Bloomberg detailed how the Nature Conservancy, the world’s biggest environmental group and a prominent seller of carbon offsets, had sold “worthless” credits to JPMorgan, Disney and BlackRock as the corporations sought to finance the protection of carbon-absorbing forest land to absolve them of their sins tied to fossil fuel usage.

Back in December, Bloomberg published a sweeping expose that raised serious questions about the ESG investing craze sweeping the world. In the piece, Bloomberg detailed how the Nature Conservancy, the world’s biggest environmental group and a prominent seller of carbon offsets, had sold “worthless” credits to JPMorgan, Disney and BlackRock as the corporations sought to finance the protection of carbon-absorbing forest land to absolve them of their sins tied to fossil fuel usage.

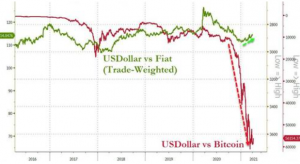

Bitcoin Shows Us That Not All Volatilities Are Created Equal

Bitcoin Shows Us That Not All Volatilities Are Created Equal Florida is suing the Centers for Disease Control and Prevention to resume U.S. cruise sailings, calling the lockdown “arbitrary and capricious” and citing hundreds of millions of dollars in potential losses for the state economy.

Florida is suing the Centers for Disease Control and Prevention to resume U.S. cruise sailings, calling the lockdown “arbitrary and capricious” and citing hundreds of millions of dollars in potential losses for the state economy. Markets were shaken but unstirred by the collapse of Greensill and the Archegos unwind trades. Credit Suisse is the ultimate loser of the two scandals – reputationally damaged and holed below the water line. The bank is paying the price of years of flawed management, poor risk awareness. and its self-belief it was still a Tier 1 global player. Its’ challenge is to avoid becoming the Deutsche Bank of Switzerland – which it will struggle to do without a radical and unlikely shakeout.

Markets were shaken but unstirred by the collapse of Greensill and the Archegos unwind trades. Credit Suisse is the ultimate loser of the two scandals – reputationally damaged and holed below the water line. The bank is paying the price of years of flawed management, poor risk awareness. and its self-belief it was still a Tier 1 global player. Its’ challenge is to avoid becoming the Deutsche Bank of Switzerland – which it will struggle to do without a radical and unlikely shakeout.  GameStop plans to elect activist investor Cohen as chairman

GameStop plans to elect activist investor Cohen as chairman ‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US”

‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US”