Dollar Death Knell: IMF Introduces World Currency

Anthony Migchels, 05 April 2021

Anthony Migchels: “Henry, something big happened last week: the IMF is going to give out loans in SDR. Special Drawing Rights are their currency. By itself, they’re nothing special, but the IMF has always lent in Dollars.

Anthony Migchels: “Henry, something big happened last week: the IMF is going to give out loans in SDR. Special Drawing Rights are their currency. By itself, they’re nothing special, but the IMF has always lent in Dollars.

That they are going to print their own currency on a large scale, $650 billion to begin with, is simply monumental. It means that World Currency is starting.

This is EXACTLY what Mark Carney (BoE chief) announced 18 months ago. That the Petrodollar would end ‘in ten years’, and would be replaced with an IMF World Reserve Currency. I reported on it here. There’s Going to be a Gold Standard & It Will Be Disastrous.”

“Make no mistake: if there’s a World Central Bank, and a World Reserve Currency, open World Government is not far away.”

Shares in GameStop fell on Monday after the video-game retailer said it may sell up to $1bn (£720m) worth of stock as it tries to make the best of the 900% surge in its shares from a Reddit-driven rally this year.

Shares in GameStop fell on Monday after the video-game retailer said it may sell up to $1bn (£720m) worth of stock as it tries to make the best of the 900% surge in its shares from a Reddit-driven rally this year.

More than 2 months have passed since Robinhood shut off trading in Gamestop while the firm’s shares soared past the $400 mark, marking a historic confrontation between an army of GME-hodling “apes” and hedge funds like Melvin Capital, not to mention the mighty hedge fund-market maker Citadel, that would cement GME’s status as a favorite of the “Wall Street Bets” retail-trading army.

More than 2 months have passed since Robinhood shut off trading in Gamestop while the firm’s shares soared past the $400 mark, marking a historic confrontation between an army of GME-hodling “apes” and hedge funds like Melvin Capital, not to mention the mighty hedge fund-market maker Citadel, that would cement GME’s status as a favorite of the “Wall Street Bets” retail-trading army. Blockchain evaluation agency, Chainalysis’ newest crime report has named Mirror Buying and selling Worldwide (MTI) as the largest cryptocurrency rip-off of 2020. Chainalysis arrived at this conclusion after an investigation discovered that MTI had taken in $589 million from greater than 471,000 deposits. In line with the report, MTI’s haul is considerably greater than that of Forsage and J-enco, the following greatest scams. Each scams raked in lower than $350 million every.

Blockchain evaluation agency, Chainalysis’ newest crime report has named Mirror Buying and selling Worldwide (MTI) as the largest cryptocurrency rip-off of 2020. Chainalysis arrived at this conclusion after an investigation discovered that MTI had taken in $589 million from greater than 471,000 deposits. In line with the report, MTI’s haul is considerably greater than that of Forsage and J-enco, the following greatest scams. Each scams raked in lower than $350 million every.  SoftBank Group Corp. said today it has invested $2.8 billion to acquire a 40% stake in Norwegian warehouse automation company AutoStore AS.

SoftBank Group Corp. said today it has invested $2.8 billion to acquire a 40% stake in Norwegian warehouse automation company AutoStore AS.

Dusted off an anecdote from 2016 that explores the meaning of money. It is worth considering after a quarter in which the US dollar declined by more than 50% versus the dominant digital assets and the S&P 500 closed at an all-time high.

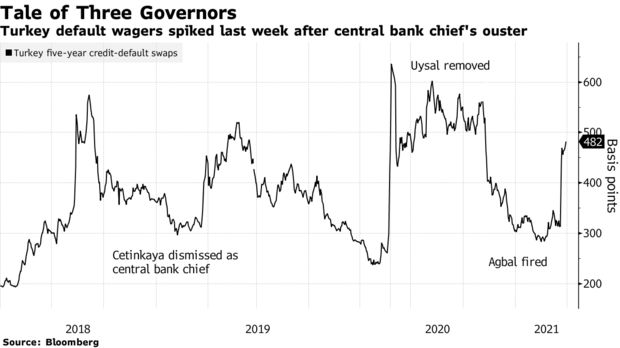

Dusted off an anecdote from 2016 that explores the meaning of money. It is worth considering after a quarter in which the US dollar declined by more than 50% versus the dominant digital assets and the S&P 500 closed at an all-time high. The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations.

The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations. Non-fungible tokens, or NFTs, are changing the way we think about art (and other collectibles), and in 2021, investors have started to take notice. As Decrypt writes, in the last year, NFTs have shot to the forefront of the crypto space. The cryptographically-unique tokens make it possible to create real-world scarcity for digital objects, and artists have seized on the opportunity presented by the technology.

Non-fungible tokens, or NFTs, are changing the way we think about art (and other collectibles), and in 2021, investors have started to take notice. As Decrypt writes, in the last year, NFTs have shot to the forefront of the crypto space. The cryptographically-unique tokens make it possible to create real-world scarcity for digital objects, and artists have seized on the opportunity presented by the technology.