Feds spotlight Miami as capital of COVID-19 fraud, from business to employee benefits

JAY WEAVER, 26 March 2021

A year ago, Congress agreed to spend hundreds of billions of dollars on benefits for small businesses and employees devastated by the coronavirus pandemic.

Of course, the government’s handout helped the struggling economy. But it also opened the door for a menagerie of con artists to fleece the federal relief program to get rich quick.

Among them: a South Florida man alleged to have bought a Lamborghini for $318,000 with millions in COVID-19 relief loans; a Broward County tax preparer who purportedly pocketed huge commissions for filing $28 million worth of phony business loan applications; and a former NFL player from Miami accused of stealing people’s identities to collect $300,000 in unemployment insurance benefits. Continue reading “Article: Feds spotlight Miami as capital of COVID-19 fraud, from business to employee benefits”

Former Central Prison employee charged with embezzlement

Former Central Prison employee charged with embezzlement Tense YMCA board scrambles to replace CEO amid scandal

Tense YMCA board scrambles to replace CEO amid scandal

Triads, shopping bags full of cash, money laundering – if you’ve been following the inquiry into Crown Resorts run by New South Wales authorities, you might think there aren’t many allegations left to be hurled at the casino operator.

Triads, shopping bags full of cash, money laundering – if you’ve been following the inquiry into Crown Resorts run by New South Wales authorities, you might think there aren’t many allegations left to be hurled at the casino operator. A former governor of Tamaulipas, Mexico on Thursday pleaded guilty in a Texas court for taking over $3.5 million in bribes for government contracts, which he then laundered in the United States.

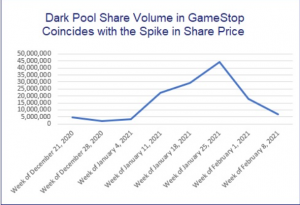

A former governor of Tamaulipas, Mexico on Thursday pleaded guilty in a Texas court for taking over $3.5 million in bribes for government contracts, which he then laundered in the United States. A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price

A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price