If the SEC doesn’t regulate crypto assets, a new shadow finance industry could emerge

PATRICK AUGUSTIN, 08 May 2021

The Securities and Exchange Commission (SEC) is dragging its feet in deciding whether it should approve the listing of a Bitcoin exchange-traded fund (ETF) proposed by VanEck Associates Group. While it is good to be cautious, speed and political decisiveness are equally important. Otherwise we risk the rise of a digital shadow finance industry.

The Securities and Exchange Commission (SEC) is dragging its feet in deciding whether it should approve the listing of a Bitcoin exchange-traded fund (ETF) proposed by VanEck Associates Group. While it is good to be cautious, speed and political decisiveness are equally important. Otherwise we risk the rise of a digital shadow finance industry.

Cryptocurrencies are here to stay. The opportunities brought about by the digitization of assets and new financial technologies make it challenging to reverse the course of financial innovation. Continue reading “Article: If the SEC doesn’t regulate crypto assets, a new shadow finance industry could emerge”

Last September, armed gardaí charged with tackling Ireland’s drugs criminals searched properties 200km apart in Mountmellick, Co Laois, and the tiny village of Lisselton, Co Kerry, seizing nearly €4 million in cash.

Last September, armed gardaí charged with tackling Ireland’s drugs criminals searched properties 200km apart in Mountmellick, Co Laois, and the tiny village of Lisselton, Co Kerry, seizing nearly €4 million in cash. The European Banking Authority (EBA) is setting up a centralised database to name and shame financial institutions in the EU that have weak anti-money laundering (AML) controls.

The European Banking Authority (EBA) is setting up a centralised database to name and shame financial institutions in the EU that have weak anti-money laundering (AML) controls. Corus Entertainment Inc., which has produced shows led by actors such as Christopher Plummer, plans to take an opportunistic approach to U.S. and Canadian high-yield bond markets after a recent debt sale fetched strong investor demand, Chief Financial Officer John Gossling said.

Corus Entertainment Inc., which has produced shows led by actors such as Christopher Plummer, plans to take an opportunistic approach to U.S. and Canadian high-yield bond markets after a recent debt sale fetched strong investor demand, Chief Financial Officer John Gossling said. From Piggly Wiggly to GameStop, short squeezes have been causing drama on the stock markets for more than a century. Read on to learn about the biggest short squeezes in history and how to take part in the next one.

From Piggly Wiggly to GameStop, short squeezes have been causing drama on the stock markets for more than a century. Read on to learn about the biggest short squeezes in history and how to take part in the next one. SAN DIEGO (KGTV) – More people are turning to the internet to find love during the pandemic, but it can come with a high price.

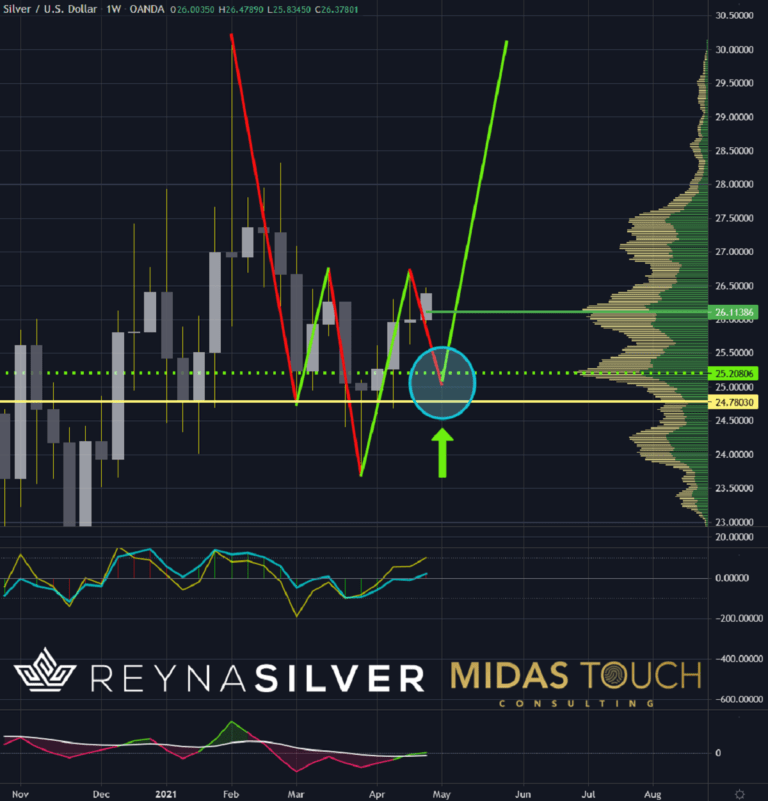

SAN DIEGO (KGTV) – More people are turning to the internet to find love during the pandemic, but it can come with a high price. Gaining certainty about a clear picture of the future is getting more complex by the minute. Data arrives of never-seen occurrences that make it seemingly impossible to know how everything will pan out. President Biden demands higher taxation of the rich and a minimum wage of US$15. News about Silver market manipulation introduces fear into this market sector. Janet Yellen spoke of inflation. Many are talking about a possible hyperinflation. Others however are pointing towards the “Japanization” of America. On top, a recent New York Times headline reads: “Reaching herd immunity is unlikely in the U.S.”. All this noise is creating more confusion and pressure instead of clarity. The good news is: You do not need to know how the future unfolds to preserve your wealth. And Silver eats doubt for breakfast.

Gaining certainty about a clear picture of the future is getting more complex by the minute. Data arrives of never-seen occurrences that make it seemingly impossible to know how everything will pan out. President Biden demands higher taxation of the rich and a minimum wage of US$15. News about Silver market manipulation introduces fear into this market sector. Janet Yellen spoke of inflation. Many are talking about a possible hyperinflation. Others however are pointing towards the “Japanization” of America. On top, a recent New York Times headline reads: “Reaching herd immunity is unlikely in the U.S.”. All this noise is creating more confusion and pressure instead of clarity. The good news is: You do not need to know how the future unfolds to preserve your wealth. And Silver eats doubt for breakfast.  Banking regulators around the globe were busy last year despite the Covid-19 pandemic. Like any other year, the regulators imposed heavy fines on banks and financial institutions for a range of indiscretions, including money laundering, tax evasion and market manipulation. It is estimated that total bank fines amounted to more than $14 billion in 2020, with the U.S. accounting for the majority of them with 12 bank fines. Anti-money laundering (AML) breaches were the most common violation last year. Detailed below are the ten biggest bank fines of 2020.

Banking regulators around the globe were busy last year despite the Covid-19 pandemic. Like any other year, the regulators imposed heavy fines on banks and financial institutions for a range of indiscretions, including money laundering, tax evasion and market manipulation. It is estimated that total bank fines amounted to more than $14 billion in 2020, with the U.S. accounting for the majority of them with 12 bank fines. Anti-money laundering (AML) breaches were the most common violation last year. Detailed below are the ten biggest bank fines of 2020.  The financial watchdog overseeing Danske Bank A/S says the European Union needs to re-examine the limits of client privacy if it’s serious about fighting money laundering and other forms of financial crime.

The financial watchdog overseeing Danske Bank A/S says the European Union needs to re-examine the limits of client privacy if it’s serious about fighting money laundering and other forms of financial crime.