One of World’s Greatest Hidden Fortunes Is Wiped Out in Days

Katherine Burton and Tom Maloney, 30 March 2021

From his perch high above Midtown Manhattan, just across from Carnegie Hall, Bill Hwang was quietly building one of the world’s greatest fortunes.

Even on Wall Street, few ever noticed him — until suddenly, everyone did.

Hwang and his private investment firm, Archegos Capital Management, are now at the center of one of the biggest margin calls of all time — a multibillion-dollar fiasco involving secretive market bets that were dangerously leveraged and unwound in a blink. Continue reading “Article: One of World’s Greatest Hidden Fortunes Is Wiped Out in Days”

It was a bleak moment for the oil industry. U.S. shale companies were failing by the dozen. Petrostates were on the brink of bankruptcy. Texas roughnecks and Kuwaiti princes alike had watched helplessly for months as the commodity that was their lifeblood tumbled to prices that had until recently seemed unthinkable. Below $50 a barrel, then below $40, then below $30.

It was a bleak moment for the oil industry. U.S. shale companies were failing by the dozen. Petrostates were on the brink of bankruptcy. Texas roughnecks and Kuwaiti princes alike had watched helplessly for months as the commodity that was their lifeblood tumbled to prices that had until recently seemed unthinkable. Below $50 a barrel, then below $40, then below $30.

“Things @Tesla has done for me in the past 2 days: 1) stolen 5 figures directly from my bank account, and that of at least 400 other buyers 2) not delivered the car that was promised yesterday and paid for (TWICE, as it turns out) 3) provided zero contact. Thanks, @elonmusk!” one of these Tesla buyers, Tom Slateery, posted on Twitter.

“Things @Tesla has done for me in the past 2 days: 1) stolen 5 figures directly from my bank account, and that of at least 400 other buyers 2) not delivered the car that was promised yesterday and paid for (TWICE, as it turns out) 3) provided zero contact. Thanks, @elonmusk!” one of these Tesla buyers, Tom Slateery, posted on Twitter. Danske Bank A/S’ capital levels and projected first-quarter earnings imply that it could withstand a money-laundering fine of 20.9 billion kroner, or $3.3 billion, today and still achieve its management common equity Tier 1 ratio target of 16%, according to S&P Global Market Intelligence estimates.

Danske Bank A/S’ capital levels and projected first-quarter earnings imply that it could withstand a money-laundering fine of 20.9 billion kroner, or $3.3 billion, today and still achieve its management common equity Tier 1 ratio target of 16%, according to S&P Global Market Intelligence estimates. Unlike the devastating London Whale debacle in 2012, which was all JPMorgan eventually drawn and quartered quite theatrically before Congress (and was a clear explanation of how banks used Fed reserves to manipulate markets, something most market participants had no idea was possible), this time JPMorgan was nowhere to be found in the aftermath of the historic margin call that destroyed hedge fund Archegos. Which is may explain why JPMorgan bank analyst Kian Abouhossein admits he is quite “puzzled” by the recent fallout from the Archegos implosion (or maybe JPM simply was not a Prime Broker of the notorious Tiger cub), which however does not prevent him from trying to calculate the capital at risk from the Archegos collapse.

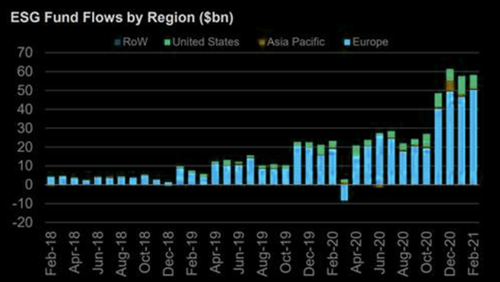

Unlike the devastating London Whale debacle in 2012, which was all JPMorgan eventually drawn and quartered quite theatrically before Congress (and was a clear explanation of how banks used Fed reserves to manipulate markets, something most market participants had no idea was possible), this time JPMorgan was nowhere to be found in the aftermath of the historic margin call that destroyed hedge fund Archegos. Which is may explain why JPMorgan bank analyst Kian Abouhossein admits he is quite “puzzled” by the recent fallout from the Archegos implosion (or maybe JPM simply was not a Prime Broker of the notorious Tiger cub), which however does not prevent him from trying to calculate the capital at risk from the Archegos collapse.  Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).

Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).

Las Vegas Sands Corp. set up a special committee to look into potential breaches of anti-money laundering procedures at its Singapore casino, which has already been the target of probes by U.S. officials and local police.

Las Vegas Sands Corp. set up a special committee to look into potential breaches of anti-money laundering procedures at its Singapore casino, which has already been the target of probes by U.S. officials and local police.