NFTs: Legal Risks from “Minting” Art and Collectibles on Blockchain

Quinn Emanuel Urquhart & Sullivan, LLP, 25 March 2021

The growth of NFTs in art has been fueled by its unique attributes. NFTs can allow artists to better monetize their work by selling NFTs directly online without middlemen. Access to a readily accessible online resale market could also mean that works gain value quickly. And unlike the traditional U.S. art market, artists may benefit from the rise in value of their work by incorporating commission requirements in the smart contracts that accompany NFTs (for example, the SuperRare NFT marketplace requires that creators receive a 10% commission when artwork continues to trade on the secondary market).[2]

Some hope that NFTs will open up a new revenue source for artists, including underrepresented artists, either by allowing artists who traditionally do not sell in galleries to sell directly to buyers online, or by allowing artists to sell something in addition to their tangible works. For example, an artist could sell an NFT of the digital image of a painting or sculpture to one buyer, while selling the physical work to another buyer, allowing the artist an additional opportunity to profit from the work. Continue reading “Article: NFTs: Legal Risks from “Minting” Art and Collectibles on Blockchain”

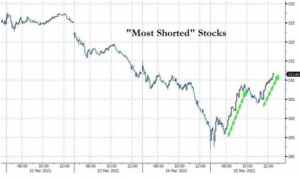

Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain

Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain