The Mystery of the $113 Millıon Deli

Jesse Barron, 02 June 2021

In a letter to his investors this April, David Einhorn, founder of the hedge fund Greenlight Capital and a well-known short-seller, complained that the stock market was in a state of “quasi anarchy.” As one piece of evidence, he pointed to Elon Musk, whose commentary on Twitter, Einhorn said, amounted to market manipulation. “The laws don’t apply to him, and he can do whatever he wants,” Einhorn noted. As another example, he cited a restaurant in rural New Jersey called Your Hometown Deli, which despite making $13,976 in revenue last year had somehow attained a value of $113 million on the stock market. Continue reading “Article: The Mystery of the $113 Millıon Deli”

In a letter to his investors this April, David Einhorn, founder of the hedge fund Greenlight Capital and a well-known short-seller, complained that the stock market was in a state of “quasi anarchy.” As one piece of evidence, he pointed to Elon Musk, whose commentary on Twitter, Einhorn said, amounted to market manipulation. “The laws don’t apply to him, and he can do whatever he wants,” Einhorn noted. As another example, he cited a restaurant in rural New Jersey called Your Hometown Deli, which despite making $13,976 in revenue last year had somehow attained a value of $113 million on the stock market. Continue reading “Article: The Mystery of the $113 Millıon Deli”

Money laundering, for the general public, is the stuff of gritty dramas like Ozark or the notorious dealings of Pablo Escobar and El Chapo. In popular culture, it is depicted as an activity to be done in the dark of night with neatly-stacked wads of cash deposited into duffel bags. The reality, however, is much more banal, with most money laundering occurring in the guise of an unremarkable series of transactions designed to obfuscate the trail for any who might be inclined to investigate.

Money laundering, for the general public, is the stuff of gritty dramas like Ozark or the notorious dealings of Pablo Escobar and El Chapo. In popular culture, it is depicted as an activity to be done in the dark of night with neatly-stacked wads of cash deposited into duffel bags. The reality, however, is much more banal, with most money laundering occurring in the guise of an unremarkable series of transactions designed to obfuscate the trail for any who might be inclined to investigate. Cash-strapped businesses grappling with the cost of the pandemic are increasingly securing loans against the value of unpaid invoices, or ‘factoring’ as it is often referred to.

Cash-strapped businesses grappling with the cost of the pandemic are increasingly securing loans against the value of unpaid invoices, or ‘factoring’ as it is often referred to. Reconnaissance Energy Africa continues to come under fire from various sources, including short sellers, but it has received public affirmation for its plans from local government in Namibia.

Reconnaissance Energy Africa continues to come under fire from various sources, including short sellers, but it has received public affirmation for its plans from local government in Namibia. SWEETWATER, Tenn. – A two-day undercover operation by special agents with the Tennessee Bureau of Investigation’s Human Trafficking Unit, the Sweetwater Police Department, the Monroe County Sheriff’s Office, the 10th Judicial District Drug & Violent Crime Task Force, Homeland Security Investigations, and the office of 10th District Attorney General Steve Crump resulted in the arrest of several men accused of seeking illicit sex from minors.

SWEETWATER, Tenn. – A two-day undercover operation by special agents with the Tennessee Bureau of Investigation’s Human Trafficking Unit, the Sweetwater Police Department, the Monroe County Sheriff’s Office, the 10th Judicial District Drug & Violent Crime Task Force, Homeland Security Investigations, and the office of 10th District Attorney General Steve Crump resulted in the arrest of several men accused of seeking illicit sex from minors.

BEIJING (Reuters) – China’s central bank on Tuesday issued a revised draft anti-money laundering law, under which fines for certain offences would rise to as much as 10 million yuan ($1.6 million) and a host of non-financial institutions would be brought within its scope.

BEIJING (Reuters) – China’s central bank on Tuesday issued a revised draft anti-money laundering law, under which fines for certain offences would rise to as much as 10 million yuan ($1.6 million) and a host of non-financial institutions would be brought within its scope. Congrats to America’s finance bros for finally getting their reward from the Chinese Communist Party. But surely, after obediently lobbying in favor of opening up to Beijing for decades, Wall Street deserved more than it received.

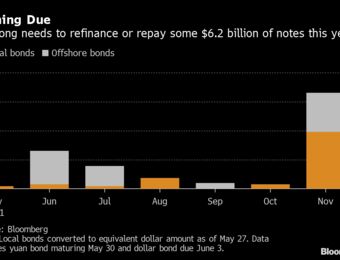

Congrats to America’s finance bros for finally getting their reward from the Chinese Communist Party. But surely, after obediently lobbying in favor of opening up to Beijing for decades, Wall Street deserved more than it received. China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter.

China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter. HONG KONG—Buffeted by rising costs, some Chinese manufacturers are refusing to accept new orders or are even considering shutting down operations temporarily—moves that could put more strain on global supply chains and cause more inflation.

HONG KONG—Buffeted by rising costs, some Chinese manufacturers are refusing to accept new orders or are even considering shutting down operations temporarily—moves that could put more strain on global supply chains and cause more inflation. ew information is revealing that Elon Musk still has the Securities and Exchange Commission (SEC) on his behind acting like Twitter police over his tweets about Tesla.

ew information is revealing that Elon Musk still has the Securities and Exchange Commission (SEC) on his behind acting like Twitter police over his tweets about Tesla. Focusing on romance scams, online sextortion, investment fraud, voice phishing and money laundering associated with illegal online gambling, police in nine Asian countries arrested more than 500 suspects and seized US$83 million, Interpol said on Thursday.

Focusing on romance scams, online sextortion, investment fraud, voice phishing and money laundering associated with illegal online gambling, police in nine Asian countries arrested more than 500 suspects and seized US$83 million, Interpol said on Thursday. AMC Entertainment Holdings (NYSE:AMC) is going on the offensive, selling over $230 million worth of stock to hedge fund operator Mudrick Capital Management at a premium so it can use the proceeds to make acquisitions.

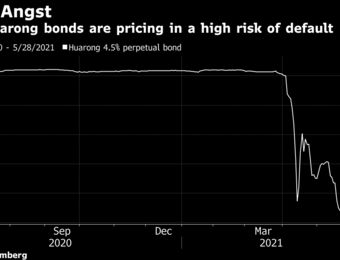

AMC Entertainment Holdings (NYSE:AMC) is going on the offensive, selling over $230 million worth of stock to hedge fund operator Mudrick Capital Management at a premium so it can use the proceeds to make acquisitions. China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity.

China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity.