Is Another Family Office Blowing Up: JPM Dumps 9MM Share Block Of ASO After Hours

TYLER DURDEN, 07 April 2021

In the aftermath of the Archegos blow up, the biggest nightmare on Wall Street – where there is never just one cockroach – is that (many) more Archegos-style, highly levered “family office” blow ups are waiting just around the corner.

In the aftermath of the Archegos blow up, the biggest nightmare on Wall Street – where there is never just one cockroach – is that (many) more Archegos-style, highly levered “family office” blow ups are waiting just around the corner.

Well, in a transaction after the close that is sure to spark much heated controversy tonight and tomorrow morning, Bloomberg announced that JPMorgan was offering a 9 million block of Academy Sports and Outdoors (ASO) stock. Since this is virtually identical to what happened two Fridays ago when similar public BWICs by Goldman and other banks proceeded to unwind the Archegos portfolio, the immediate question on everyone’s lips is whether a second highly levered family office has blown up. Continue reading “Article: Is Another Family Office Blowing Up: JPM Dumps 9MM Share Block Of ASO After Hours”

The collapse of UK-based supply chain finance firm Greensill Capital continues to reverberate. In Germany the private banking association has paid out around €2.7 billion to more than 20,500 Greensill Bank customers as part of its deposit guarantee scheme after the bank collapsed in early March. But the deposits of institutional investors such as other financial institutions, investment firms, and local authorities are not covered. Fifty municipalities are believed to be nursing losses of at least €500 million.

The collapse of UK-based supply chain finance firm Greensill Capital continues to reverberate. In Germany the private banking association has paid out around €2.7 billion to more than 20,500 Greensill Bank customers as part of its deposit guarantee scheme after the bank collapsed in early March. But the deposits of institutional investors such as other financial institutions, investment firms, and local authorities are not covered. Fifty municipalities are believed to be nursing losses of at least €500 million.  The GameStop saga stopped the stock market in its tracks earlier this year, with wealthy hedge funds losing millions of pounds. The move was orchestrated on a subreddit thread, with vast numbers of average investors joining forces to push up the share price.

The GameStop saga stopped the stock market in its tracks earlier this year, with wealthy hedge funds losing millions of pounds. The move was orchestrated on a subreddit thread, with vast numbers of average investors joining forces to push up the share price. Goldman Sachs managed to avoid billions of dollars in potential losses from the implosion of highly levered hedge fund Archegos Capital Management by breaking ranks with other syndicate banks to dump large blocks of shares representing Archegos’s exposure to a coterie of tech and media names. When the dust settled, the bank told shareholders any losses would be insignificant, while Credit Suisse, the bank with perhaps the biggest exposure, said Tuesday it has booked a nearly $5 billion loss.

Goldman Sachs managed to avoid billions of dollars in potential losses from the implosion of highly levered hedge fund Archegos Capital Management by breaking ranks with other syndicate banks to dump large blocks of shares representing Archegos’s exposure to a coterie of tech and media names. When the dust settled, the bank told shareholders any losses would be insignificant, while Credit Suisse, the bank with perhaps the biggest exposure, said Tuesday it has booked a nearly $5 billion loss.  Over the past few days, Bitcoin Cash has been recording significant price surges, appreciating by over 30 percent in value. Despite the impressive bull run, Bitcoin Cash recently experienced a price correction towards the $600 region. At present, multiple technical indicators are showing BCH could experience further price declines.

Over the past few days, Bitcoin Cash has been recording significant price surges, appreciating by over 30 percent in value. Despite the impressive bull run, Bitcoin Cash recently experienced a price correction towards the $600 region. At present, multiple technical indicators are showing BCH could experience further price declines.  XRP, the currency that runs on the digital payment platform RippleNet, hit $1 on Tuesday morning EDT, becoming the fourth highest-valued cryptocurrency with a $45.5 billion market cap despite being sued by the U.S. agency that works against market manipulation.

XRP, the currency that runs on the digital payment platform RippleNet, hit $1 on Tuesday morning EDT, becoming the fourth highest-valued cryptocurrency with a $45.5 billion market cap despite being sued by the U.S. agency that works against market manipulation. South Korea’s government has pledged to focus on illegal activities in crypto markets.

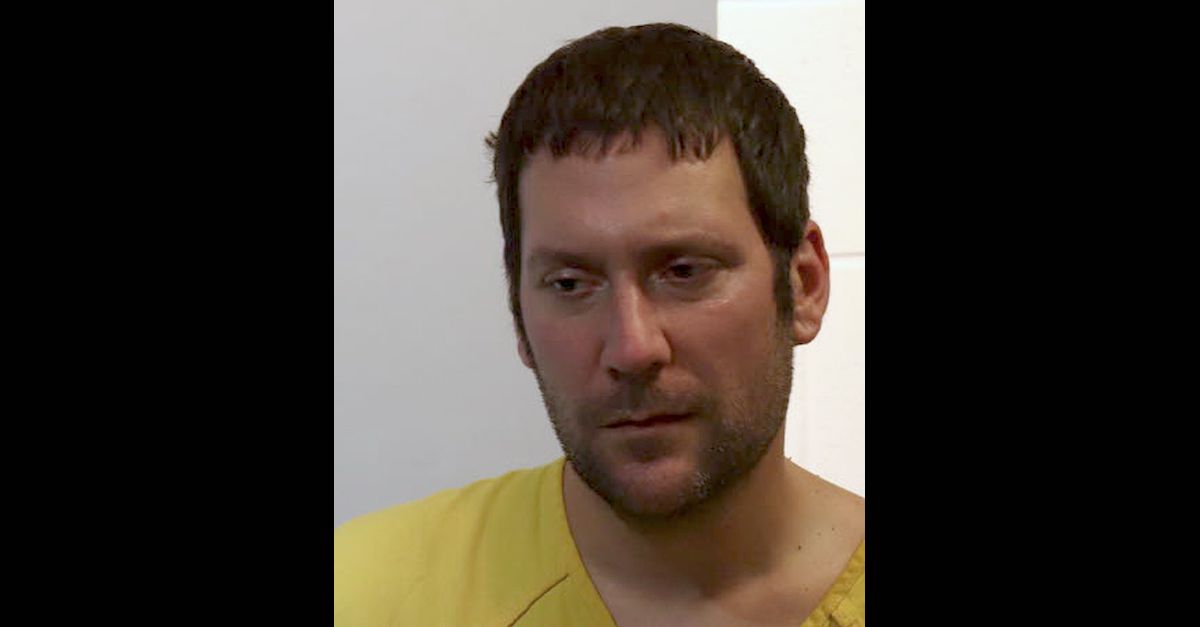

South Korea’s government has pledged to focus on illegal activities in crypto markets.  A former Florida tax collector and close associate of Rep. Matt Gaetz (R-Fla.) is facing a 45-page federal indictment alleging wire fraud, sex trafficking, and a litany of other offenses connected to the alleged abuse of his office and other crimes. That former tax collector, Joel Greenberg, is suspected of being a possible cooperating witness against Gaetz, Politico and others have recently reported, as Gaetz faces a reported inquiry into his own sexual behavior.

A former Florida tax collector and close associate of Rep. Matt Gaetz (R-Fla.) is facing a 45-page federal indictment alleging wire fraud, sex trafficking, and a litany of other offenses connected to the alleged abuse of his office and other crimes. That former tax collector, Joel Greenberg, is suspected of being a possible cooperating witness against Gaetz, Politico and others have recently reported, as Gaetz faces a reported inquiry into his own sexual behavior.  Investors engaged in naked short selling will be fined up to 100 percent of their order amount, the nation’s top financial regulator said Tuesday.

Investors engaged in naked short selling will be fined up to 100 percent of their order amount, the nation’s top financial regulator said Tuesday.