The Elon Musk Effect: The Timeless Power Of Disruption And Brand Authority

Ben Constanty, 25 February 2021

The odds are good that you have been impacted by the network effect, or when a product increases in value when more individuals begin adopting and using said product. A few examples include the telephone and the internet.

Company CEOs such as Elon Musk have recently expedited this process by using their personal brands to create a massive network effect in different industries. To get a better understanding, we need to dive in further. Continue reading “Article: The Elon Musk Effect: The Timeless Power Of Disruption And Brand Authority”

Institutional investors suing some of the world’s largest banks for manipulating the foreign exchange market will have to prove their losses were not passed on to others after a London court ruled on Thursday that the issue has to be determined at trial.

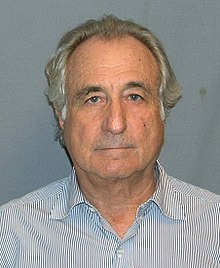

Institutional investors suing some of the world’s largest banks for manipulating the foreign exchange market will have to prove their losses were not passed on to others after a London court ruled on Thursday that the issue has to be determined at trial. Bernard Lawrence Madoff (

Bernard Lawrence Madoff ( At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling.

At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling. ROBERT STEELE: This article is such crap. As if DTCC had not willfully covered up $100 trillion in naked short counterfeit sales these past 15-20 years. Until DTCC is given a porcupine enema and we sent DOJ, FBI, and US Southern District Attorneys to jail for life for treason — enabling foreign collusion and domestic crime against the US economy — for life, this will not change.

ROBERT STEELE: This article is such crap. As if DTCC had not willfully covered up $100 trillion in naked short counterfeit sales these past 15-20 years. Until DTCC is given a porcupine enema and we sent DOJ, FBI, and US Southern District Attorneys to jail for life for treason — enabling foreign collusion and domestic crime against the US economy — for life, this will not change. Gary J. Aguirre is an American

Gary J. Aguirre is an American  r/wallstreetbets, also known as WallStreetBets or WSB, is a

r/wallstreetbets, also known as WallStreetBets or WSB, is a  Bob O’Brien is a senior writer at

Bob O’Brien is a senior writer at  William Jefferson Clinton (

William Jefferson Clinton (