Huarong Wires $978 Million to Repay Bonds as Doubts Persist

Bloomberg News, 31 May 2021

China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity.

China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity.

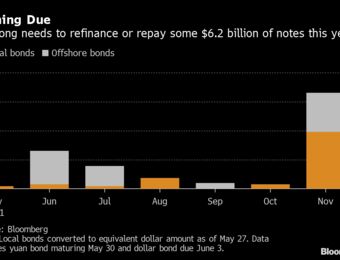

Huarong wired funds for a $900 million dollar bond due June 3, a person familiar with the matter said, asking not to be identified discussing private information. One of the company’s onshore units also paid a 500 million yuan ($78 million) bond that matured Sunday, people familiar said.

While Huarong’s longer-dated bonds still trade at levels that imply a high risk of default, the state-owned company has yet to miss a payment since it spooked investors by failing to report annual results at the end of March. Huarong has reached funding agreements with state-owned banks to ensure it can repay debt through at least the end of August, by which time the company aims to have completed its 2020 financial statements, people familiar with the matter said earlier this month.

The firm’s dollar notes were largely unchanged Monday. Its 3.75% bond maturing 2022 is indicated at 76 cents on the dollar, while the firm’s 4% perpetual bond is at 57 cents, Bloomberg-compiled prices show as of 6:15 p.m. in Hong Kong.